Now that the dust has settled and you know my financial starting point, I’d like to point out some developmental characteristics and philosophies that I have nurtured over my life. See, these characteristics are the reason that I am able to share this moment with you right now. My mental and philosophical development is vastly more important than my monetary reality. I am a firm believer that your mind is in more control of your reality than you realize. The power that rest in between your ear lobes is sufficient enough to pull the strings necessary to land you behind bars or behind a desk. Your interpretation of your situation is more your reality than the actual reality.

As a kid, I daydreamed allot. I was constantly questioning my situation, focusing in on details and asking why, letting my mind wonder off into endless possibilities about the future. As a kid, nothing was impossible for me. I’m sure most kids can relate. What changes in adulthood for most is that reality starts to poison your imagination. When you wonder about your future, instead of seeing endless possibilities, your mind begins to limit itself, eliminating those possibilities that are harder to manifest. In adulthood, as my peers begin to focus in on their life, I find it hard to not ask myself: what does it take to be different make it to the top? This mental block that most people begin to exhibit doesn’t exist for me. I’m assuming in order make it to the top (from wherever you are) you must confront this mind trick and not allow it to limit your dreams.

I have always had a desire for learning. In high school, I was constantly reading and strived to take on a tougher class load. I embarked on the International Baccalaureate Program to challenge myself further in high school. This passion for learning has never left me. As I get older, and technology gets more advanced, I find myself addicted to Google searches and Wikipedia articles. Again, I assume to follow me on this trip, you must have a passion for learning and bettering yourself constantly.

I believe that anyone can improve these qualities and that these are the main qualities of success: the ability to dream big, and the yearning for improvement and knowledge.

I will follow this up shortly with some quick steps I made to change my financial situation for the better.

Saturday, October 4, 2008

The Reality of Savings

Okay, I didn't quite tell the whole truth in my previous post. I suppose the prelude to this blog would have been made a month and a half ago.

On August 25, 2008 I started a savings account. I took a portion of my check and kept it for myself, promising to myself to keep $150 from each of my checks. Now, at first, this was like pulling teeth. Like many others, my financial situation had grown equally proportional to the amount of money that I was bringing in. Shrinking that income, would mean changing my lifestyle, maybe not even paying some bills, or even worse, not being able to eat out 4 and 5 times a week. Despite my worries, I muscled through, and immediately extracted $150 from my paycheck. Surprisingly, after the first couple of times, saving the money seemed natural. Even more surprisingly, my lifestyle didn't change much at all. Truthfully, I seem to be getting by just as easily now than before, only this time my savings account is growing.

To maximize my savings, I opened an ING Orange Savings Account. It was very easy to do online and the customer service was immediate and very reassuring. There was no minimum deposit and no fees, offering a 3.00% variable interest rate. The online access allows me to link my checking account to my ING Savings account and transfer money from either at will. I made it a habit to transfer $150 each pay period into my savings account. At the time, I enjoyed a one time bonus of $25 just for opening the account. I currently have $475.65 in this account (and will be adding $150 next week).

ING Direct is not the only only online bank that offers decent interest rates with little to no fees and minimums. They just stuck out to me at the time when I was looking for one. So far, I have no reason to look else where. ING certainly doesn't have the highest interest rate, just check out what you find when you search "online savings accounts" on Google.

What's more important to me is that I am actually keeping some of what I'm earning. And I'm protecting myself from myself by separating this money from the money I plan on spending. You'd be surprised at how much easier it is to save money when you don't have immediate access to it. If you don't believe that, test yourself to see how long actual cash stays in your pocket.

On August 25, 2008 I started a savings account. I took a portion of my check and kept it for myself, promising to myself to keep $150 from each of my checks. Now, at first, this was like pulling teeth. Like many others, my financial situation had grown equally proportional to the amount of money that I was bringing in. Shrinking that income, would mean changing my lifestyle, maybe not even paying some bills, or even worse, not being able to eat out 4 and 5 times a week. Despite my worries, I muscled through, and immediately extracted $150 from my paycheck. Surprisingly, after the first couple of times, saving the money seemed natural. Even more surprisingly, my lifestyle didn't change much at all. Truthfully, I seem to be getting by just as easily now than before, only this time my savings account is growing.

To maximize my savings, I opened an ING Orange Savings Account. It was very easy to do online and the customer service was immediate and very reassuring. There was no minimum deposit and no fees, offering a 3.00% variable interest rate. The online access allows me to link my checking account to my ING Savings account and transfer money from either at will. I made it a habit to transfer $150 each pay period into my savings account. At the time, I enjoyed a one time bonus of $25 just for opening the account. I currently have $475.65 in this account (and will be adding $150 next week).

ING Direct is not the only only online bank that offers decent interest rates with little to no fees and minimums. They just stuck out to me at the time when I was looking for one. So far, I have no reason to look else where. ING certainly doesn't have the highest interest rate, just check out what you find when you search "online savings accounts" on Google.

What's more important to me is that I am actually keeping some of what I'm earning. And I'm protecting myself from myself by separating this money from the money I plan on spending. You'd be surprised at how much easier it is to save money when you don't have immediate access to it. If you don't believe that, test yourself to see how long actual cash stays in your pocket.

Labels:

Caleb Nelson,

ing account,

savings

Friday, October 3, 2008

Where I Started

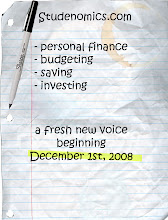

Hi. My name is Caleb. I am 24, still in college and working full-time to survive in the Washington, DC metropolitan area. I am embarking on a journey of wits and determination in a world much unknown to myself. I have been living a rather mediocre life, and as things seem to get more and more mundane I can't help but to look for something more. I'm sure there are plenty of people out there who feel the same and are waiting for someone to show them a way out. I can't guarantee that everyone reading this will get rich, but what I can promise is that I will be completely honest as I embark on this journey. Hopefully, as I learn these lessons of fortune, I can help others on their way to the top.

This is day one: It's 6:38pm (according to the clock on my computer) Friday, October 3, 2008. I suppose I should start from scratch. Hopefully everyone, if anyone, that follows can better connect the dots for themselves this way.

And the bitter beginning is I currently have -$38.05 in my bank account. I made a slight miscalculation and overdrafted my account by $3.05, which in turn caused the bank to charge a $35 overdraft fee. Ooooouchh!

Luckily, I get paid on Monday!

My goal is not to just make some extra money, but to completely transform my financial situation and perspective, and hopefully show others how to do the same. I will continue to post, addressing relevant topics, and updating my story of how I made it to the top.

This is day one: It's 6:38pm (according to the clock on my computer) Friday, October 3, 2008. I suppose I should start from scratch. Hopefully everyone, if anyone, that follows can better connect the dots for themselves this way.

And the bitter beginning is I currently have -$38.05 in my bank account. I made a slight miscalculation and overdrafted my account by $3.05, which in turn caused the bank to charge a $35 overdraft fee. Ooooouchh!

Luckily, I get paid on Monday!

My goal is not to just make some extra money, but to completely transform my financial situation and perspective, and hopefully show others how to do the same. I will continue to post, addressing relevant topics, and updating my story of how I made it to the top.

Labels:

Caleb Nelson,

how I started,

money

Subscribe to:

Comments (Atom)